The Board acknowledges that at the year end the Company had net current liabilities primarily due to a loan of £15m from the Company’s wholly owned subsidiary, Youtan Limited, which was repayable on demand. The Company had cash and liquid resources of £1.8m at 31 March 2020 (excluding cash held in portfolio companies). The overall performance of the Ordinary Shares remains robust and the total return since inception as at 31 March 2020 was 116.7p per Ordinary Share. The Board has not assigned any current value to the claim in the net asset value reported. The non-binding offer communicated in my Chairman’s Statement in the Half-Yearly Financial Report unfortunately failed to progress, therefore the Company continues to follow up this claim in the courts. The Ordinary Shares fund ended the year with investments in portfolio companies with total generating capacity of 75.0MW compared with 78.0MW at 31 March 2019.įollowing the award of the Spanish claim (equivalent to £2m-£2.5m, or 5.6-7.1p per Ordinary Share) communicated in the last annual report, there continues to remain significant challenges with respect to collectability. With a portfolio now solely situated in the UK, the Board consider the Ordinary Shares fund to be optimally invested and well placed to maximise future returns for Shareholders. The Board was also pleased that the Investment Manager was able to complete the refinancing of the investment portfolio in June 2020, reducing finance costs across the portfolio. Telecomponenti, the small Italian rooftop asset, was also sold post period end, completing in July 2020. Total electricity production of the sites operated was 1.9% above expectations at 71.48 gigawatt hours of electricity, sufficient to power approximately 24,000 UK homes for a year.ĭuring the year, following the Board’s decision to refocus the portfolio, the Company’s existing portfolio companies successfully divested from the ForVEI II platform returning c.£6.2m to the fund, corresponding to a multiple of c.1.08x in less than 18 months. As described further in the Investment Manager’s report on page 8 of the Annual Report and Accounts, changes in the macro environment, including the COVID-19 pandemic, have caused the long term power price forecasts to fall significantly. This decrease was driven by a fall in the underlying value of the portfolio caused by a material reduction in market power prices forecast by the energy industry’s independent, external modelling agencies. The underlying net asset value decreased by 17.7p per Ordinary Share before deducting the 6.0p per Ordinary Share dividend paid during the year. On behalf of the Board, I would like to thank the previous Chairman, David Hurst-Brown, who retired from the Board in September 2019, for his valuable contributions and stewardship of the Company during his tenure, and to wish him well for the future.

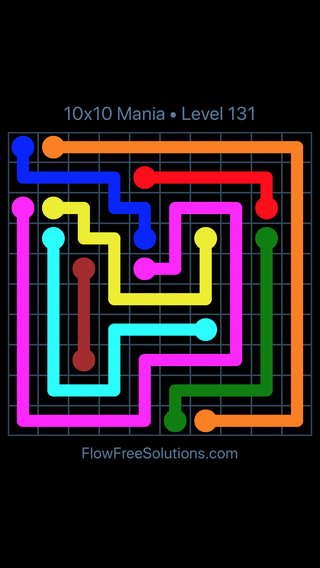

FLOW FREE BRIDGES LEVEL 10X10 DAILY CHALLENGE UPDATE

During the year the portfolio generated 71.48 gigawatt hours of electricity, sufficient to power approximately 24,000 UK homes for a year.Īt 31 March 2020, the fund also held positions in one Italian solar asset with a total installed capacity of 0.4MW.ĭuring the year, our existing portfolio company completed the disposal of its entire interest in the ForVEI II platform, returning c.£6.2m to the fund, corresponding to a multiple of c.1.08x in less than 18 months.Īs your new Chairman and on behalf of the Board, I am pleased to present the Annual Report and Accounts for Foresight Solar & Technology VCT Plc (formerly Foresight Solar & Infrastructure VCT Plc) for the year ended 31 March 2020 and to provide you with an update on the exciting developments affecting the Company, including the rebranding of the Company and the launch of the new share class, the Foresight Williams Technology Shares. On 19 September 2019, David Hurst-Brown retired from the Board, with Ernie Richardson taking over as Chairman.Īt 31 March 2020, the fund held positions in 12 UK solar assets, with a total installed capacity of 74.7MW. The Company completed a tender offer in March 2020, allowing holders of Ordinary Shares an opportunity to exit their investment at a price of 81.2p per share, which represents a total return of 125.2p per share, net of all expenses and performance fees. The fall in Net Asset Value was largely driven by a material reduction in market power prices forecast by the energy industry’s independent, external modelling agencies. Two interim dividends of 3.0p per Ordinary Share were paid during the year, on 26 April 2019 and 22 November 2019.Īfter payment of 6.0p in dividends, Net Asset Value per Ordinary Share at 31 March 2020 was 72.7p (31 March 2019: 96.4p). Ordinary Shares Net Asset Value per share as at 31 March 2020: 72.7pįoresight Williams Technology Shares Total Net Assets as at 31 March 2020: £1.1m Ordinary Shares Total Net Assets as at 31 March 2020: £25.8m

0 kommentar(er)

0 kommentar(er)